2022 Property Tax Information

Outagamie County will mail City of Kaukauna property tax bills out tomorrow, December 15th. They are also published online here.

Payment options include:

- Pay online: https://kaukauna.gov/pay-online/

- Credit Card – 2.2% convenience fee (of total payment)

- Debit Card – $3.50 convenience fee

- E-check – no convenience fee

- US Postal Mail

- Mailed to City of Kaukauna – 144 W 2nd St – Kaukauna, WI 54130

- City Clerk’s Office at the Municipal Services Building (144 W 2nd St) – Monday through Friday, 8:00am to 4:00pm

- Please note, the Municipal Services Building is closed to the public on December 23rd, December 26th, and January 2nd.

- Drop box in the Municipal Services Building parking lot (144 W 2nd St)

- Bank of Kaukauna (264 W Wisconsin Ave) – Monday through Friday, 9:00am – 4:00pm

Full payment, or the first installment, is due January 31st, 2023. After January 31st, tax payments will be accepted by Outagamie County via credit card, e-check, or by mailing a check to Outagamie County Treasurer – 320 S. Walnut Street, Appleton, WI 54911. More information is available on their website – https://www.outagamie.org/government/departments-n-z/treasurer – or by calling 920.832.5065. *Note, a convenience fee will be charged – see online payment fees above.

Additional items of note on your tax bill:

- If a receipt is needed, please send a self-addressed and stamped envelope along with your tax payment.

- Homeowners should check for lottery and gaming credit deduction (primary residence only).

- Dog licenses can be purchased on our website – https://kaukauna.gov/pay-online/

- Per City ordinance, please remember to shovel your sidewalks within 48 hours of a snowfall.

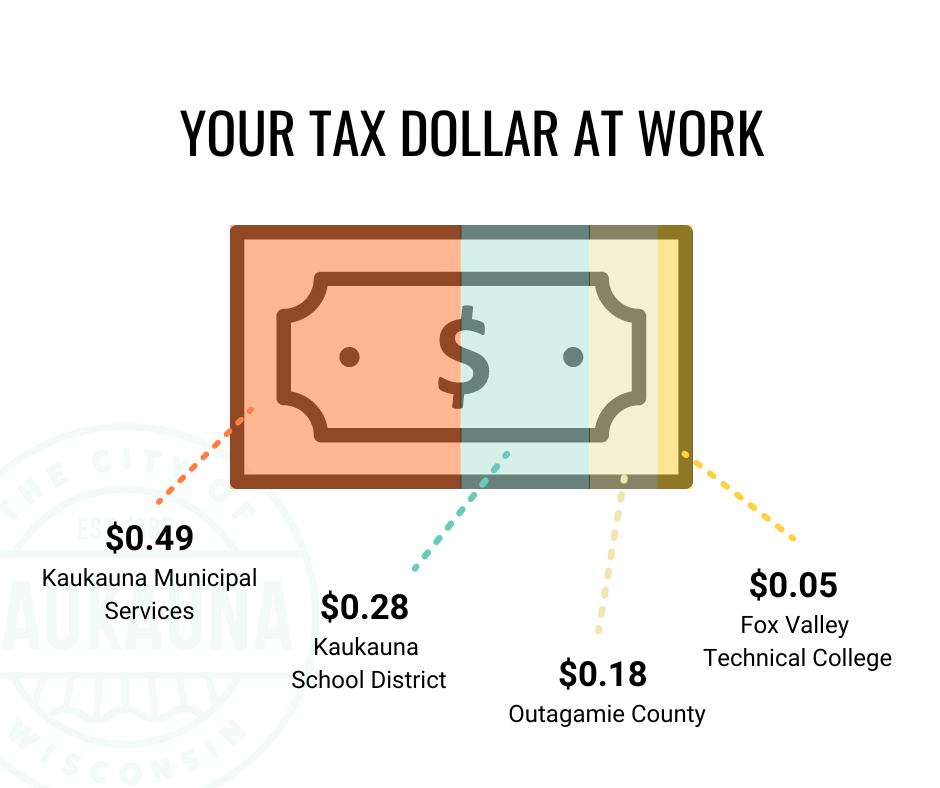

How are tax bills allocated? The graphic below shows a breakdown of your tax dollar at work.

For further information on property taxes, please call the City Finance Department at 920.766.6312.